INTRODUCTION

In this section, we will provide an overview of the tutorial on Bingx Futures Trading for beginners. We will explain what Bingx Futures Trading is, discuss its benefits, and provide a link for signing up on Bingx.

Overview of the Tutorial

This tutorial is a step-by-step guide for beginners on how to trade Futures on Bingx. It will cover topics such as transferring assets from a spot account to a futures account, navigating the user interface, and demonstrating trades using different types of orders and stop losses.

Explanation of Bingx Futures Trading

Bingx Futures Trading is a platform that allows users to trade futures contracts. Futures contracts are agreements to buy or sell an asset at a predetermined price and date in the future. Bingx offers futures trading for various cryptocurrencies, such as Bitcoin and Ethereum.

Benefits of Trading Futures on Bingx

There are several benefits to trading futures on Bingx:

- Leverage: Bingx allows users to trade with leverage, which can amplify potential gains.

- Liquidity: Bingx has a large user base, providing ample liquidity for futures trading.

- Low Fees: Bingx offers competitive fees for futures trading, with different rates for makers and takers.

- User Rewards: Bingx often runs promotions for new users, such as deposit bonuses and giveaways.

Link to Sign Up for Bingx

If you are interested in trading futures on Bingx, you can sign up using the following link: [Insert Bingx sign up link here]. By signing up using this link, you will be eligible for any current Bingx promotions and will support the creator of this tutorial.

TRANSFERRING ASSETS

Transferring assets from a spot account to a futures account is a crucial step in Bingx Futures Trading. Here are the steps you need to follow:

- Go to the wallet icon and click on “Transfer” in the drop-down menu.

- On the transfer form, select the account you want to transfer from and the account you want to transfer to. Bingx offers two types of futures accounts: Perpetual futures account and Coin margin futures account.

- If you want to trade with USDT pairings, select the Perpetual futures account. If you want to trade with coin margin pairings, select the Coin margin futures account.

- Keep in mind that settling profits and losses will depend on the type of account you choose. In the Perpetual futures account, profits and losses will be settled in the underlying asset. In the Coin margin futures account, profits and losses will be settled in the coin you are trading.

- Enter the amount you want to transfer and click on “Transfer”. Your assets will be transferred successfully.

To learn more about Fiat purchasing options and other advanced trading features, check out the tutorials on the Bingx website.

Transferring assets is an important step in getting started with Bingx Futures Trading. By following these steps, you can easily transfer your assets between accounts and start trading futures contracts.

NAVIGATING THE USER INTERFACE

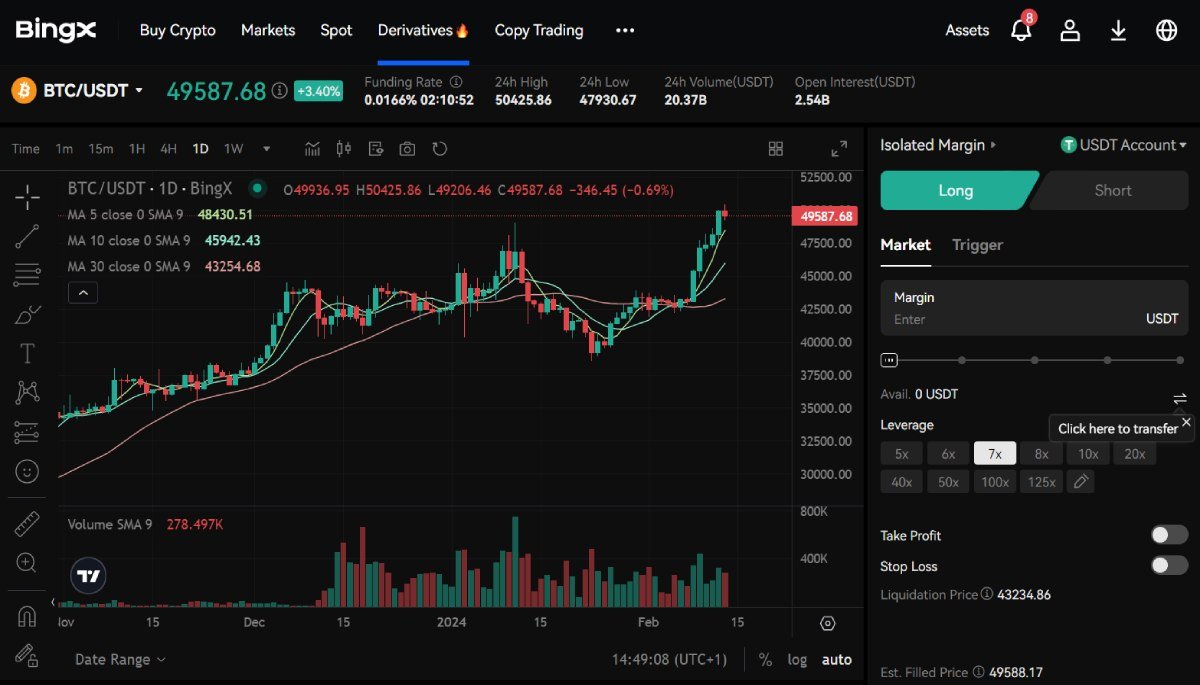

When using Bingx Futures Trading, it is important to understand how to navigate the user interface to effectively trade futures contracts. This section will provide an overview of the user interface and explain its key features.

Futures Market User Interface on Bingx

The Futures Market user interface on Bingx is designed to provide traders with access to real-time market data, order books, and trading tools. The interface is intuitive and user-friendly, making it easy for beginners to navigate.

Price Action Chart and Available Time Frames

The price action chart on Bingx allows traders to visualize the performance of assets over different time frames. Traders can choose from a variety of time frames, such as 15 minutes, daily, or even custom time frames. The chart is powered by TradingView, providing traders with access to drawing tools and basic indicators.

Drawing Tools and Indicators

Bingx offers a range of drawing tools and indicators that traders can use to analyze price trends and make informed trading decisions. These tools include trend lines, Fibonacci retracements, brushes, and rectangles. Traders can customize their charts by adding their favorite drawing tools to a tab for easy access.

Customizing the Appearance of the Chart

Traders have the option to customize the appearance of the price action chart to suit their preferences. They can adjust grid lines, color schemes, and other visual elements of the chart. By right-clicking on the chart and accessing the settings, traders can easily modify the appearance of their charts.

MARKET ORDERS

A market order is a type of order in Bingx Futures Trading that is executed immediately at the best available price off the order book. It allows users to enter a position quickly without having to manually set a specific price.

When placing a market order, traders have the option to choose the amount of leverage they want to use. Leverage amplifies potential gains, but it also increases the risk of losses. It is important for beginners to start with low leverage or no leverage until they have developed a solid trading strategy and risk management plan.

Traders also need to select the position size when placing a market order. The position size determines the amount of assets that will be used for the trade. It is important to carefully consider the position size to ensure that it aligns with the trader’s risk tolerance and overall trading strategy.

Another important aspect of market orders is calculating the estimated liquidation price. The liquidation price is the price at which a trader’s position will be automatically closed to prevent further losses. Traders need to be aware of their estimated liquidation price to manage risk and avoid being liquidated.

Traders can also set a take profit and stop loss for their open position. This allows them to automatically close the position at a predetermined price, either to lock in profits or limit losses.

To demonstrate opening and closing a position with a market order, traders can follow these steps:

- Select the desired trading pair and click on “Market” in the order panel.

- Choose the amount of leverage and position size.

- Click on “Open Long” or “Open Short” depending on the desired trade direction.

- Review the order confirmation details, including the estimated liquidation price.

- Click on “Confirm” to execute the market order.

- To close the position, click on “Position” in the order panel, then select “Market Close”.

- Choose the amount of the position to close and click on “Confirm”.

Traders can also set a take profit and stop loss for their open position. This allows them to automatically close the position at a predetermined price, either to lock in profits or limit losses. It is recommended to set take profit and stop loss levels to manage risk and protect trading capital.

By understanding market orders and how to use them effectively, beginners can quickly enter and exit positions in Bingx Futures Trading. It is important to practice responsible trading and always consider the potential risks and rewards before making any trading decisions.

LIMIT ORDERS

Limit orders are a type of order used in strategic trading on Bingx Futures Trading. They allow traders to specify a specific price point at which they want to open a position. By using limit orders, traders can be more strategic in their trading decisions and potentially save on fees.

Comparison of Fees

When placing a market order, traders are charged a taker fee, which is typically higher than the fee for placing a limit order. Bingx charges a taker fee of 0.05% for market orders and a maker fee of 0.02% for limit orders. By using limit orders, traders can save on fees and potentially increase their overall profitability.

Setting a Price Point

When placing a limit order, traders have the ability to set a specific price point at which they want to open a position. This allows them to enter the market at a price they deem favorable. Traders can analyze market trends and determine the best price at which to enter a position based on their trading strategy.

Demonstration of Placing a Limit Order

To place a limit order on Bingx, traders can follow these steps:

- Select the desired trading pair and click on “Limit” in the order panel.

- Choose the amount of leverage and position size.

- Enter the desired price point for opening the position.

- Review the order confirmation details, including the estimated liquidation price.

- Click on “Confirm” to execute the limit order.

By setting a specific price point with a limit order, traders can have more control over their entry into a position and potentially increase their chances of success.

Considerations when Using Limit Orders

When using limit orders, traders should consider the following:

- Market Volatility: Limit orders may not execute if the market price does not reach the specified price point. Traders should consider market volatility and set realistic price targets.

- Timeframe: Limit orders remain on the order book until they are filled or cancelled by the trader. Traders should monitor their limit orders and make adjustments if necessary.

- Liquidation Risk: Traders should be aware of their estimated liquidation price when setting limit orders. If the market moves against their position and reaches the liquidation price, their position may be automatically closed.

By understanding these considerations and using limit orders strategically, traders can enhance their trading experience on Bingx Futures Trading and potentially improve their overall profitability.

TRADING FEES

Trading fees are an important aspect to consider when trading futures on Bingx. Here is an explanation of the trading fees on Bingx:

Bingx charges different rates for makers and takers. A maker is a trader who places a limit order on the order book, while a taker is a trader who executes a market order that is immediately filled from the order book.

The current maker fee on Bingx is 0.02%, while the taker fee is 0.05%. The maker fee is lower because makers provide liquidity to the order book, while takers consume liquidity.

It’s important to note that trading fees can vary and may change over time, so it’s always a good idea to check the current fee schedule on Bingx’s website.

By understanding the trading fees on Bingx, traders can make informed decisions about the type of orders they want to place and manage their trading costs effectively.

CONCLUSION

In conclusion, this tutorial on Bingx Futures Trading for beginners has provided an overview of how to trade futures on Bingx. It covered topics such as transferring assets, navigating the user interface, and placing market and limit orders. Here is a recap of the tutorial:

- Transferring assets from a spot account to a futures account is a crucial step in Bingx Futures Trading. The tutorial explained the steps to follow, including selecting the account type and settling profits and losses based on the chosen account.

- The user interface of Bingx Futures Trading was discussed, highlighting the price action chart, available time frames, drawing tools, and indicators. Customization options were also mentioned to suit individual preferences.

- Market orders and limit orders were explained in detail. The tutorial provided step-by-step instructions on how to open, close, and set take profit and stop loss levels for both types of orders.

- Trading fees on Bingx were also addressed, with different rates for makers and takers. Traders were advised to check the current fee schedule on Bingx’s website for the most up-to-date information.

To further enhance your knowledge and skills in Bingx Futures Trading, it is encouraged to check out other Bingx tutorials by the author. These tutorials cover additional topics and provide valuable insights for traders of all levels.

To support the author and stay updated on future tutorials, don’t forget to like their content, subscribe to their channel, and leave comments with any questions or feedback. The author appreciates your support and wishes you success in your futures trading journey.

FAQ

Here are some frequently asked questions about Bingx Futures Trading:

Answers to Frequently Asked Questions about Bingx Futures Trading

- Q: What is Bingx Futures Trading?

- A: Bingx Futures Trading is a platform that allows users to trade futures contracts, agreements to buy or sell an asset at a predetermined price and date in the future.

- Q: What are the benefits of trading futures on Bingx?

- A: There are several benefits, including leverage, liquidity, low fees, and user rewards.

- Q: How do I transfer assets from a spot account to a futures account?

- A: You can transfer assets by going to the wallet icon, clicking on “Transfer” in the drop-down menu, selecting the account you want to transfer from and to, and entering the amount you want to transfer.

- Q: How do I navigate the user interface on Bingx Futures Trading?

- A: The user interface on Bingx Futures Trading is intuitive and user-friendly. You can customize the appearance of the price action chart, access drawing tools and indicators, and navigate the order book.

- Q: What are market orders and limit orders?

- A: BingX execute market orders immediately at the best available price, while limit orders allow traders to specify a specific price point at which they want to open a position.

- Q: How do I set a take profit and stop loss for my open position?

- A: You can set a take profit and stop loss by clicking on “Position” in the order panel, selecting “Market Close” for closing the position, and entering the desired take profit and stop loss levels.

- Q: What are the trading fees on Bingx?

- A: Bingx charges different rates for makers and takers, with a maker fee of 0.02% and a taker fee of 0.05%. It’s always a good idea to check the current fee schedule on Bingx’s website.

Additional Resources for Further Learning

If you want to learn more about Bingx Futures Trading, you can check out the tutorials on the Bingx website. These tutorials cover topics such as advanced trading features, fiat purchasing options, and more.

Do Independent Research and Exercise Caution

It’s important to remember that futures trading involves risks, and it’s always a good idea to do your own research and exercise caution when trading on Bingx or any other platform. Make sure to understand the risks involved and only trade with funds you can afford to lose.

EXCHANGE CRYPTO AND GET $50 FREE !

GET $50 FOR FREE IN YOUR SIMPLESWAP ACCOUNT!1 – Just sign up to SimpleSwap through this link

2 – Finish a crypto exchange using our exclusive promo code : u5bz3pBhYsMdeZYt

3 – Find $50 in BTC in your Customer Account !