PHEMEX TUTORIAL FOR BEGINNERS

PHEMEX TUTORIAL FOR BEGINNERS. Welcome to this Phemex tutorial for beginners! In this tutorial, we will provide you with a brief overview of the Phemex crypto exchange and cover various topics to help you get started. Whether you're interested in fiat currency deposits and withdrawals, spot trading, or contract trading, we've got you covered.

Throughout this tutorial, we will provide timestamps for easy navigation, as well as mention any sign-up or deposit bonuses that may be available. So keep an eye out for those!

One exciting feature that Phemex offers is its Learn platform, which allows you to practice simulated trading with paper money. This is a great way for beginners to familiarize themselves with the platform and gain confidence before using real money.

Now, let's dive into the various topics covered in this tutorial and help you become a Phemex pro!

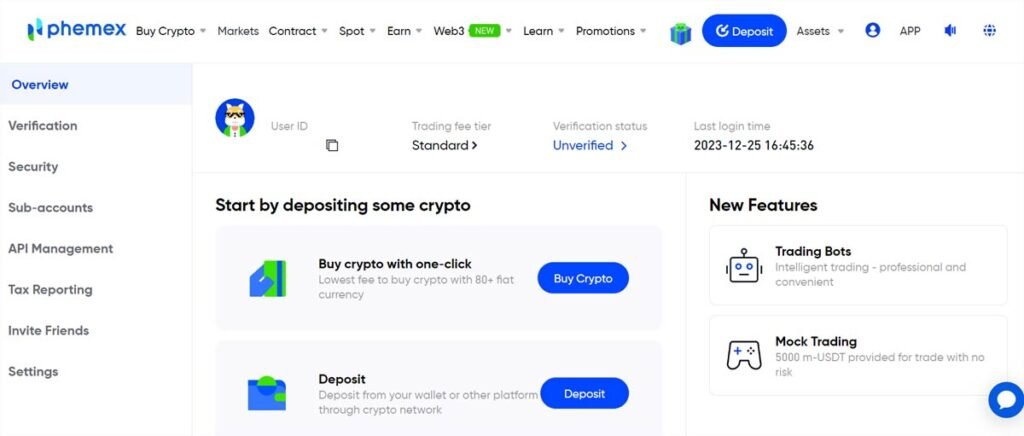

Creating an Account

Creating an account with Phemex is a simple process that can be completed in a few easy steps. Here is a step-by-step guide to help you get started:

- Visit the Phemex website and click on the "Create Account" button located in the top right corner of the homepage.

- Fill out the registration form with your email address and create a strong password.

- Read and accept the terms and conditions of Phemex.

- Click on the verification link sent to your email to confirm your account.

- Once your account is confirmed, you can log in to Phemex using your email address and password.

It is important to note that certain activities on Phemex, such as fiat currency deposits and withdrawals, require users to complete the KYC (Know Your Customer) process. This involves providing identification documents and verifying your residential address. The KYC process is a standard practice that helps ensure compliance with financial regulations and prevents fraudulent activities.

To enhance the security of your Phemex account, it is highly recommended to set up Google Authenticator. Google Authenticator is a two-factor authentication app that adds an extra layer of security to your account. It generates a unique authentication code that you need to enter along with your password when logging in. This helps protect your account from unauthorized access.

When setting up Google Authenticator, it is crucial to keep a backup of the authentication code. Phemex provides a QR code and a long code that you should screenshot and securely store. This ensures that you can still access your account even if you lose your phone or encounter any issues with the app. Phemex tutorial for beginners.

Depositing and Withdrawing Fiat Currency

If you're interested in depositing and withdrawing fiat currency on Phemex, this section will provide you with the necessary information to get started. Please note that certain activities, such as fiat currency deposits and withdrawals, require completion of the KYC (Know Your Customer) process. This involves providing identification documents and verifying your residential address.

Instructions for Depositing Fiat Currency using Legend Trading

To deposit fiat currency, you can use Legend Trading, a third-party US regulated crypto trading firm partnered with Phemex. Here's how you can deposit fiat currency:

- On the Phemex platform, go to "Deposit Fiat Currency".

- Enter the amount of fiat currency you want to deposit and select the currency.

- Click "Deposit" to view the bank details of Legend Trading.

- Make the deposit using the provided bank details and include the specified payment reference.

Legend Trading supports major payment networks and currencies, including same-day deposits for US payments and next-day deposits for Euro and Asia payments.

Restrictions and Supported Countries for Fiat Transactions

While Phemex allows fiat currency deposits and withdrawals, it's important to note that there are restrictions and certain countries and territories that are not supported. Please check if your jurisdiction is supported before proceeding with fiat transactions. Using a VPN or changing your IP address will not bypass these restrictions, as KYC details are required for fiat currency transactions.

Comparison of Deposit Fees for Different Payment Methods

When depositing fiat currency on Phemex, it's essential to consider the associated fees. Deposit fees vary depending on the payment method used. Depositing via credit or debit card tends to have the highest fees, usually around 5%. On the other hand, depositing through Legend Trading with a bank transfer is the cheapest option, as it only incurs a standard banking transfer fee.

It's important to consider the fees when choosing your preferred payment method for fiat deposits. Phemex tutorial for beginners.

Converting Fiat into Crypto

Converting fiat currency into cryptocurrency is a straightforward process on Phemex, thanks to its one-click buy/sell feature. This feature allows users to quickly convert their fiat currency into various crypto assets with just a few clicks.

To convert fiat currency, users can simply go to the "Deposit Fiat Currency" option on the Phemex platform. From there, they can enter the desired amount of fiat currency they want to convert and select the currency they wish to convert it into. After clicking "Deposit," users will be provided with the bank details of Legend Trading, a third-party US regulated crypto trading firm partnered with Phemex.

It is important to note that converting fiat into crypto on Phemex incurs a fee. The fee varies depending on the payment method used. Depositing via credit or debit card tends to have the highest fees, usually around 5%. On the other hand, depositing through Legend Trading with a bank transfer is the cheapest option, as it only incurs a standard banking transfer fee.

Phemex supports major payment networks and currencies, including same-day deposits for US payments and next-day deposits for Euro and Asia payments. However, it's essential to check if your jurisdiction is supported for fiat currency transactions on Phemex, as there are certain restrictions and unsupported countries.

Comparing the available fiat-to-crypto markets on Phemex, users can choose between US dollar stablecoin margin markets and USD margin markets. The former allows users to directly use stablecoins as collateral for trading, while the latter requires converting crypto into USD on the platform.

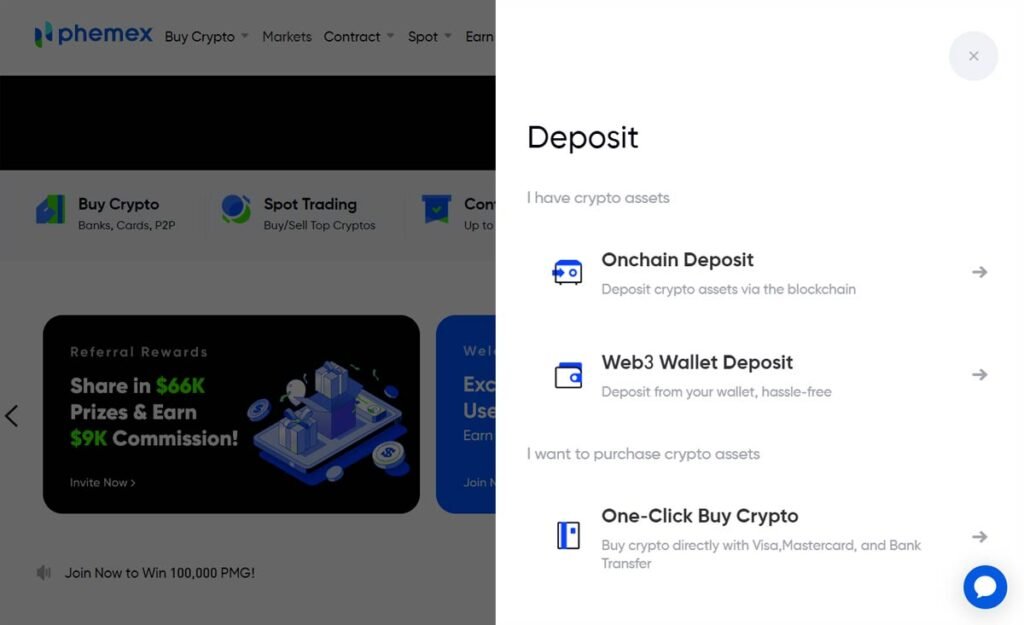

Depositing Crypto Assets

Phemex tutorial for beginners. When using the Phemex crypto exchange, it's important to understand how to deposit your crypto assets into your account. This section will guide you through the process and provide important information about supported networks and fees.

Guide to depositing crypto assets into a Phemex account

To deposit crypto assets into your Phemex account, follow these steps:

- Access the Phemex platform and navigate to the deposit section.

- Select the crypto asset you want to deposit.

- Generate a deposit address or scan the provided QR code.

- Transfer the desired amount of crypto assets to the provided address.

- Wait for the transaction to be confirmed on the blockchain.

Explanation of supported networks for crypto deposits

Phemex supports various networks for crypto deposits, including Ethereum, Tron, Solana, Polygon, and Binance Smart Chain. Each network has its own advantages and fees, so it's important to choose the network that best suits your needs.

Comparison of different network options and their fees

When depositing crypto assets, it's essential to consider the fees associated with each network option. Some networks may have lower fees, while others may have faster transaction times. Here is a comparison of the different network options and their fees:

- Ethereum: Higher fees, but widely supported and secure.

- Tron: Lower fees and faster transaction times.

- Solana: Low fees and fast transactions.

- Polygon: Low fees and quick confirmations.

- Binance Smart Chain: Low fees and good for trading Binance assets.

Importance of using the correct network for depositing crypto

Using the correct network is crucial when depositing crypto assets. If you use the wrong network, your transaction may fail, and you could risk losing your funds. It's important to double-check the network requirements and ensure that you are using the correct address for the selected network.

By following these guidelines and understanding the supported networks and their fees, you can successfully deposit your crypto assets into your Phemex account and begin trading with confidence.

Spot Trading on Phemex

Phemex tutorial for beginners. Phemex offers a spot trading platform that allows users to buy and sell cryptocurrencies. Here's an overview of the spot trading platform on Phemex:

Asset Selection and Market Trading

Phemex provides a wide selection of cryptocurrencies that can be traded on the spot trading platform. Users can choose from various assets, including Bitcoin, Ethereum, stablecoins, and fiat currencies like the Turkish lira and Brazilian real. These assets are traded against stablecoins like US dollar tether (USDT) and US dollar coin (USDC). Users can easily navigate the platform to select the desired asset and trade accordingly.

Placing Market and Limit Orders

Phemex allows users to place both market and limit orders on the spot trading platform. Market orders are executed instantly at the best available price in the market. Traders simply specify the amount of cryptocurrency they want to buy or sell, and the platform automatically matches it with the current market price.

On the other hand, limit orders allow users to set a specific price at which they want to buy or sell a cryptocurrency. This gives traders more control over their trades and allows them to set their desired price. Once the market reaches the specified price, the order is executed.

Maker and Taker Fees in Spot Trading

Phemex charges maker and taker fees for spot trading. Makers are traders who add liquidity to the order book by placing limit orders. They are rewarded with lower fees as an incentive for providing liquidity to the market. Takers, on the other hand, are traders who remove liquidity from the order book by placing market orders. They pay slightly higher fees compared to makers.

The exact fees charged by Phemex vary depending on the trading volume and the type of asset being traded. It's important for traders to be aware of these fees and consider them when placing trades on the spot trading platform.

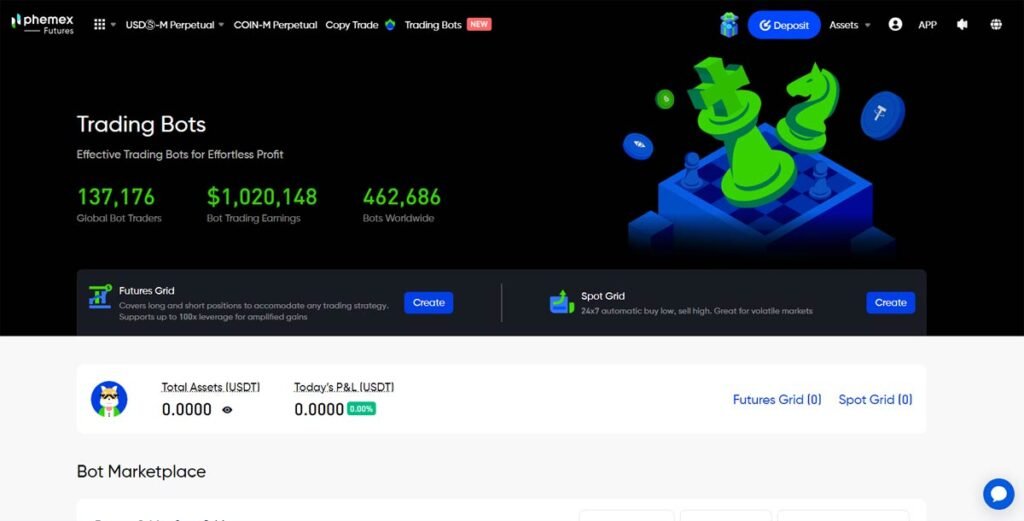

Crypto Futures Trading on Phemex

Phemex offers a robust futures trading platform that allows users to trade crypto contracts with ease. Let's explore the key features and functionalities of contract trading on Phemex.

Introduction to Contract Trading on Phemex

Contract trading, also known as futures trading, involves speculating on the future price movements of cryptocurrencies. Phemex offers a wide range of futures contracts, allowing traders to go long (buy) or short (sell) various cryptocurrencies.

With Phemex, you can trade futures contracts for popular cryptocurrencies like Bitcoin, Ethereum, and stablecoins. This gives you the opportunity to profit from both rising and falling markets.

Using Stablecoin Margin or Coin Margin

When trading futures on Phemex, you have the option to use either stablecoin margin or coin margin. Stablecoin margin allows you to use stablecoins like Tether (USDT) as collateral for trading, while coin margin requires using the actual cryptocurrency as collateral.

Using stablecoin margin can be beneficial for traders who want to avoid the price volatility of cryptocurrencies. It provides a more stable trading environment and eliminates the need to convert your cryptocurrencies into stablecoins.

Leverage and Managing Risk in Futures Trading

One of the key advantages of futures trading is the ability to trade with leverage. Phemex offers leverage options ranging from 1x to 100x, allowing you to amplify your potential profits (or losses) with a smaller initial investment.

However, it's important to note that trading with leverage also increases your risk. It's crucial to have a solid risk management strategy in place to protect your capital. This includes setting appropriate stop-loss orders and avoiding over-leveraging your trades.

Opening and Closing Positions in Futures

To open a position in futures trading, you can place either a market order or a limit order. With a market order, you buy or sell the contract at the best available price in the market. With a limit order, you set a specific price at which you want to enter the trade.

When you're ready to close your position, you can use the close order function on Phemex. This allows you to exit your trade and realize your profits or losses. You can also adjust your stop-loss and take-profit levels to manage your trades effectively.

Remember to always stay updated with the latest news and market trends when trading futures. Crypto markets can be highly volatile, and it's important to stay informed and adapt your trading strategy accordingly.

Adding and Removing Collateral in Futures Trading

Phemex tutorial for beginners. In futures trading, managing collateral is essential for adjusting margin and controlling risk. Phemex offers two options for managing collateral: cross margin and isolated margin.

Cross Margin

Cross margin is a method of margin adjustment where the total account balance is used to fund all open positions. This means that the collateral in your account is shared among all your trades. If one trade goes against you and starts losing money, the collateral from other profitable trades can be used to cover the losses. Cross margin provides a more flexible approach to managing margin but carries a higher risk if a losing position significantly impacts the overall account balance.

Isolated Margin

Isolated margin, on the other hand, allows you to allocate a specific amount of collateral for each individual trade. This means that the margin for each position is isolated and independent of other trades. If one position incurs losses, it will only affect the allocated collateral for that specific trade, minimizing the impact on other positions. Isolated margin provides better risk management, as losses in one trade won't deplete the overall account balance.

When trading futures on Phemex, you have the flexibility to choose between cross margin and isolated margin based on your risk tolerance and trading strategy.

Adding and Removing Collateral

To adjust your margin and add or remove collateral on Phemex, you can easily do so within your trading account. If you want to increase your collateral for a position, you can add funds by transferring more assets into your account from your spot wallet. This will provide additional margin coverage and reduce the risk of liquidation. Phemex tutorial for beginners.

Conversely, if you want to reduce your collateral and free up funds, you can remove excess assets from your account by transferring them back to your spot wallet or external wallet. This can be done by withdrawing the assets from your futures trading account. Phemex tutorial for beginners.

Impact of Collateral on Liquidation Price

It's important to note that the amount of collateral you have in your futures trading account directly affects your liquidation price. The liquidation price is the price at which your position will be automatically closed to prevent further losses. If the price of the asset moves unfavorably and reaches your liquidation price, your position will be liquidated, and you may incur losses.

By effectively managing your collateral and maintaining a sufficient margin, you can reduce the risk of liquidation and protect your trading capital.

Importance of Managing Margin and Risk

Managing margin and risk is crucial in futures trading to protect your capital and maximize profitability. It's essential to monitor your positions regularly, set appropriate stop-loss orders, and adjust your margin as needed.

By using proper risk management techniques and understanding the impact of collateral on your trades, you can mitigate potential losses and improve your chances of success in futures trading.

Remember, futures trading involves substantial risk, and it's important to educate yourself and seek professional advice before engaging in this type of trading.

Conclusion and FAQ

In this Phemex tutorial for beginners, we covered a range of topics to help you navigate the platform and get started with trading. Let's recap the key points covered:

- We discussed the process of creating an account on Phemex and the importance of completing the KYC process for certain activities.

- We explored the options for depositing and withdrawing fiat currency, including using Legend Trading for fiat deposits.

- We explained how to convert fiat currency into crypto on Phemex and discussed the fees associated with different payment methods.

- We provided a step-by-step guide for depositing crypto assets into your Phemex account, including information about supported networks and fees.

- We highlighted the features and functionalities of the spot trading platform on Phemex, including asset selection, market trading, and placing market and limit orders.

- We delved into the world of crypto futures trading on Phemex, discussing contract trading, using stablecoin margin or coin margin, leverage, and managing risk.

- We provided insights into adding and removing collateral in futures trading, understanding cross margin and isolated margin, and the impact of collateral on liquidation price.

Now, let's address some frequently asked questions:

Q: Can I practice trading on Phemex before using real money?

A: Yes! Phemex offers a simulated trading feature called the Learn platform, where you can practice trading with paper money. This allows beginners to familiarize themselves with the platform and gain confidence before using real money.

Q: What is the difference between spot trading and futures trading on Phemex?

A: Spot trading involves buying and selling cryptocurrencies in the current market at the best available price. Futures trading, on the other hand, involves speculating on the future price movements of cryptocurrencies using contracts. It allows traders to go long (buy) or short (sell) various cryptocurrencies.

Q: How does leverage work in futures trading?

A: Leverage allows traders to amplify their potential profits (or losses) by trading with borrowed funds. Phemex offers leverage options ranging from 1x to 100x. However, it's important to note that trading with leverage also increases your risk, and it's crucial to have a solid risk management strategy in place.

Q: Can I withdraw my crypto assets from Phemex to my own wallet?

A: Yes! Phemex allows users to withdraw their crypto assets to their own wallets. You can simply go to your spot account, click on the asset you want to withdraw, select the network, enter your wallet address, and specify the amount you want to withdraw.

For further assistance and support, you can visit the Phemex website and explore their Help Center and Support sections. They also offer trading and deposit bonuses for new users, so be sure to check out the latest promotions.

Now that you have a better understanding of Phemex and its features, we encourage you to explore the platform, continue learning, and start your journey in crypto trading. Good luck!

CRYPTO TIPS CRYPTO CASINO BONUSES (250+)