Introduction to Binance Futures

Binance Futures. Crypto Futures are synthetic contracts based on the price of another asset, allowing traders to speculate on the price of an asset without actually owning it. Binance Futures provides a platform for trading these contracts.

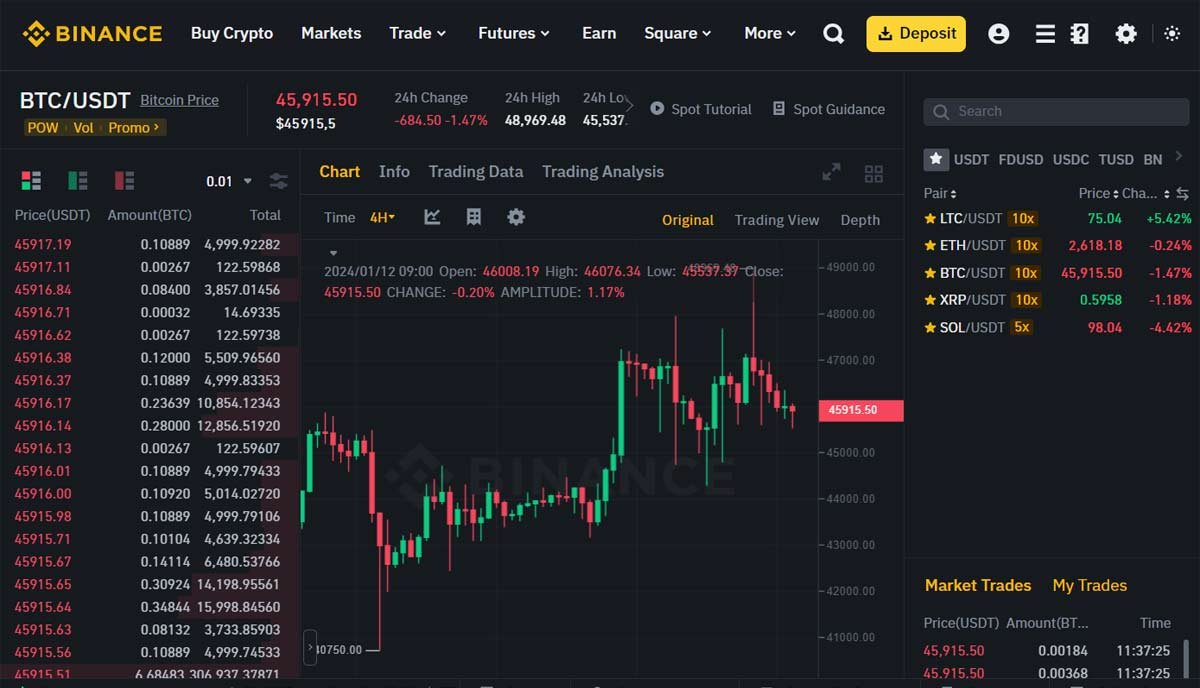

When accessing the Binance Futures trading screen, users will find several key features that differ from spot trading:

- The chart, powered by TradingView, provides a visual representation of price movements.

- The order book displays the price of the Futures contract based on the asset being traded.

- The margin ratio indicates the amount of risk users are taking when trading with leverage.

- The assets section allows users to fund their future trading account with different types of collateral, including stablecoins like USDT or crypto assets like Bitcoin.

Spot trading and Futures trading differ in that spot trading involves buying and selling the actual asset, while Futures trading only involves taking positions on the price of the asset. With Futures trading, users can go long (betting on price increase) or short (betting on price decrease) without actually owning the asset.

Getting Started with Binance Futures

If you want to start trading on Binance Futures, there are a few steps you need to follow to access the Futures trading screen:

- Go to the top of your screen and click on the "Futures" tab.

- From there, click on the "Trading Screen" for USDT Perpetual contracts.

Now that you're on the Futures trading screen, let's dive into some important concepts:

Perpetual Contracts and Delivery Futures

Perpetual contracts are the most commonly traded contracts on Binance Futures. These contracts have no expiry date, allowing you to hold your position for as long as you want. On the other hand, delivery futures have an expiry date, where you trade based on the expected price of an asset at the delivery date.

For most traders, perpetual contracts are the go-to option, as they provide more flexibility and allow you to trade based on price speculation without worrying about the contract expiring.

Choosing Collateral: USDT vs Coin Margin

When funding your positions on Binance Futures, you have two options for collateral: USDT (a stablecoin) or coin margin (using a crypto asset). Here are a few things to consider when choosing your collateral:

- USDT: Using USDT as collateral provides stability, as it is equivalent to the US dollar. It is easy to understand your profit and loss when using USDT, and it allows for quick entry and exit of trades.

- Coin Margin: Using a crypto asset as collateral can offer more profit potential during bull markets, as you are leveraging your existing crypto assets. However, it also carries more risk, as the collateral's value can fluctuate with the market.

Most traders on Binance Futures opt for USDT collateral due to its stability and ease of use. It allows them to fund positions with a known value and simplifies profit and loss calculations.

Understanding Leverage and Margin Ratio

Leverage plays a crucial role in Binance Futures trading, as it allows traders to increase their position sizes without needing to invest a large amount of capital. By utilizing leverage, traders can amplify their potential profits, but it's important to note that it also increases the risk of losses.

When using leverage, traders are essentially borrowing funds from the exchange to open larger positions. For example, with 5x leverage, a trader can open a position that is five times larger than their actual account balance. This means that a $1,000 position can be opened with just $200 of the trader's capital.

The margin ratio is a crucial factor in determining the level of risk in Binance Futures trading. It represents the amount of risk a trader is taking when trading with leverage. A higher margin ratio indicates a higher level of risk, as it means that a smaller price movement can result in liquidation.

It's important for traders to understand the difference between isolated margin and cross margin. Isolated margin allows traders to allocate a specific amount of their account balance to a single position. This helps to limit the potential losses to that specific position, as the trader's other funds are not at risk. On the other hand, cross margin utilizes all available funds in the trading account to support all open positions. This can be riskier, as losses from one position can affect the entire account balance.

CALCULATING AND MANAGING RISK WITH LEVERAGE

When trading on Binance Futures, it's important to understand how to calculate and manage risk when using leverage. This section will cover key points on using the Binance order calculator to determine liquidation prices, calculating position size based on risk percentage, and analyzing potential profits and losses with leverage.

Using the Binance Order Calculator to Determine Liquidation Prices

The Binance order calculator is a useful tool for determining the liquidation prices of your positions. By inputting the leverage, position size, and entry price, the calculator can provide you with the liquidation price at which your position would be automatically closed. This is important as it helps you assess the potential risk of your trades and make informed decisions.

Calculating Position Size Based on Risk Percentage

Another crucial aspect of managing risk with leverage is calculating the appropriate position size based on your risk tolerance. One common approach is to risk a certain percentage of your account balance per trade. For example, if your risk percentage is 2% and your account balance is $1,000, you would aim to risk $20 per trade. Using this information, you can then calculate the position size that aligns with your risk tolerance and desired stop-loss level.

Analyzing Potential Profits and Losses with Leverage

When trading with leverage, it's essential to analyze the potential profits and losses of your positions. By understanding the risk-reward ratio, you can determine whether a trade is worth taking. This involves assessing the potential profit if the trade goes in your favor compared to the potential loss if it goes against you. By considering these factors, you can make more informed decisions and manage your risk effectively.

Overall, calculating and managing risk with leverage is crucial for successful trading on Binance Futures. By utilizing tools like the Binance order calculator and considering factors such as liquidation prices, position size, and potential profits and losses, traders can make more informed decisions and mitigate risk in their trading strategies.

Managing Positions and Orders

When trading on Binance Futures, it's important to understand how to manage your positions and orders effectively. Here are some key points to consider:

Opening and Closing Positions on Binance Futures

To open a position on Binance Futures, you can choose the type of futures contract you want to trade, such as perpetual contracts or delivery futures. Perpetual contracts are the most commonly traded contracts, as they have no expiry date, allowing for more flexibility.

To open a position, you will need to choose the collateral you want to use, either USDT or coin margin. USDT collateral provides stability and is equivalent to the US dollar, while coin margin allows you to leverage your existing crypto assets.

To close a position, you can either manually sell the contract or set a take-profit order to automatically close the position when the desired profit level is reached. It's important to monitor your positions regularly and adjust your orders accordingly.

Setting Stop-Loss and Take-Profit Orders

Setting stop-loss and take-profit orders is crucial for managing risk in trading. A stop-loss order is placed to limit potential losses by automatically closing a position if the price moves against you. It helps to protect your account from significant losses.

A take-profit order, on the other hand, allows you to lock in profits by automatically closing a position when the desired profit level is reached. This helps to secure your gains without having to constantly monitor the market.

By setting both stop-loss and take-profit orders, you can define your risk-reward ratio and ensure that your trading strategy aligns with your risk tolerance.

Understanding the Difference Between One-Way and Hedge Mode

When trading on Binance Futures, you can choose between one-way and hedge mode. In one-way mode, you can only open positions in one direction (either long or short) at a time. This means that if you have an existing position, you need to close it before opening a new position in the opposite direction.

Hedge mode, on the other hand, allows you to open positions in both directions simultaneously. This can be useful for hedging purposes or for trading strategies that involve taking opposite positions on the same asset.

It's important to understand the implications of each mode and choose the one that best suits your trading style and objectives.

Trading Strategies with Funding Rates

Funding rates play a crucial role in trading Bitcoin futures on Binance. Understanding how funding rates work can help traders make informed decisions and potentially take advantage of arbitrage opportunities.

Explanation of Funding Rates and Their Impact on Trading

Funding rates are a mechanism used by futures platforms like Binance to incentivize traders and keep the price of the futures contract in line with the spot price of the underlying asset. Funding rates are periodically exchanged between long and short positions to encourage market equilibrium.

When there are more long positions (buyers) in the market, the funding rate becomes positive, meaning longs have to pay short sellers. Conversely, when there are more short positions (sellers), the funding rate becomes negative, and longs receive funding from short sellers.

Funding rates are paid or received by traders every 8 hours based on the difference between the futures contract price and the spot price. It's important to note that funding rates can fluctuate and impact a trader's overall profit or loss.

Using Funding Rates to Trade Bitcoin Futures

Traders can use funding rates to their advantage by understanding their implications and adjusting their trading strategies accordingly. Here are a few strategies that involve funding rates:

- Delta Neutral Positions: Delta neutral strategies aim to create a position that is not affected by price movements in the underlying asset. Traders can achieve delta neutrality by taking equal long and short positions in the futures market. This strategy allows traders to benefit from funding rates while minimizing their exposure to price fluctuations.

- Arbitrage: Traders can take advantage of funding rate differentials across different exchanges to engage in arbitrage. By simultaneously opening long and short positions on different platforms with varying funding rates, traders can profit from the interest rate differential.

Exploring Delta-Neutral Positions for Arbitrage Opportunities

Delta-neutral positions involve taking equal and opposite positions in the futures market to create a neutral position that is unaffected by price movements. This strategy is commonly used in arbitrage trading to exploit pricing discrepancies.

For example, if the funding rate on Binance is higher than on another exchange, a trader can go long on Binance and short on the other exchange. By doing so, the trader can earn the higher funding rate on Binance while maintaining a delta-neutral position.

It's important to note that delta-neutral strategies require careful monitoring and analysis to identify and seize arbitrage opportunities. Traders should also consider transaction costs and market conditions when implementing these strategies.

In conclusion, funding rates can significantly impact trading strategies in the Bitcoin futures market. By understanding how funding rates work and using them strategically, traders can enhance their trading performance and potentially capitalize on arbitrage opportunities.

Risk Management and Best Practices

When it comes to Binance Futures trading, risk management and best practices are crucial for successful trading. By implementing these strategies, traders can minimize potential losses and increase their chances of making profits. Here are some important considerations:

Importance of Setting Stop-Loss Levels and Managing Risk

Setting stop-loss levels is essential in managing risk. A stop-loss order allows traders to automatically exit a position if the price moves against them, limiting potential losses. By setting a stop-loss level, traders can define their maximum acceptable loss and protect their trading capital.

Managing risk is crucial in any trading strategy. This involves determining the appropriate position size, setting risk tolerance levels, and diversifying the trading portfolio. Traders should never risk more than they can afford to lose and should always be prepared for potential market fluctuations.

Tips for Avoiding Common Pitfalls in Futures Trading

- Do Your Research: Before entering any trade, it's important to conduct thorough research and analysis. This includes studying market trends, understanding the factors that influence price movements, and staying updated on relevant news and events.

- Use Stop-Loss Orders: As mentioned earlier, stop-loss orders are essential in managing risk. Always use stop-loss orders to protect your positions and prevent substantial losses.

- Practice Proper Position Sizing: Determine the appropriate position size based on your risk tolerance and account balance. Avoid overexposing yourself to risk by trading with excessive leverage or putting too much capital at stake.

- Stick to Your Trading Plan: Develop a trading plan and stick to it. Avoid making impulsive decisions based on emotions or short-term market fluctuations. A well-defined trading plan will help you stay disciplined and make more informed decisions.

- Continuous Learning: The market is constantly evolving, and it's crucial to stay updated with the latest trends and trading strategies. Continuously educate yourself about futures trading, risk management techniques, and market analysis to improve your trading skills.

Considerations for Choosing the Right Leverage and Collateral

Choosing the right leverage and collateral is important in managing risk and optimizing trading strategies. Here are some considerations:

- Leverage: Leverage can amplify potential profits but also increases the risk of losses. It's important to carefully consider the amount of leverage you use and ensure it aligns with your risk tolerance. Avoid excessive leverage that can lead to significant losses.

- Collateral: The choice of collateral depends on your risk appetite and trading preferences. USDT collateral offers stability and ease of use, while coin margin allows leveraging existing crypto assets. Assess the pros and cons of each option and choose the one that aligns with your trading goals.

In conclusion, risk management and best practices are vital for successful Binance Futures trading. By setting stop-loss levels, avoiding common pitfalls, and choosing the right leverage and collateral, traders can mitigate risks and increase their chances of profitable trading.

Conclusion and Additional Resources

In conclusion, Binance Futures provides a platform for trading synthetic contracts based on the price of different assets. By understanding key features such as perpetual contracts, choosing collateral, leverage, and margin ratios, traders can effectively navigate the Futures trading screen and manage their positions.

When trading with leverage, it's important to be aware of the potential risks and calculate the appropriate position size based on your risk tolerance. The Binance order calculator can be a useful tool for determining liquidation prices and position sizes.

Funding rates are another important factor to consider when trading Futures. Understanding how funding rates work and their impact on trading can help traders make informed decisions and potentially take advantage of arbitrage opportunities.

Managing risk and practicing best practices are crucial for successful trading. Setting stop-loss levels, sticking to a trading plan, continuous learning, and choosing the right leverage and collateral are all key considerations for risk management.

For further learning resources, Binance offers bonuses for new users and a beginner's tutorial. Additionally, the Crypto Investor Course provides in-depth videos on various aspects of crypto trading and risk management.

FAQ

What is the difference between spot trading and Futures trading?

In spot trading, traders buy and sell the actual asset, while in Futures trading, traders only take positions on the price of the asset without owning it.

How does leverage affect position sizes and risk?

Leverage allows traders to increase their position sizes without needing to invest a large amount of capital. However, it also increases the risk of losses. With higher leverage, a smaller price movement can result in liquidation.

What are the risks and benefits of trading with funding rates?

Trading with funding rates allows traders to potentially earn additional funds from long positions or pay fees if holding short positions. However, these rates can fluctuate and impact a trader's overall profit or loss.

How can I calculate my liquidation price and manage risk?

Using tools like the Binance order calculator, traders can determine their liquidation prices by inputting leverage, position size, and entry price. It's important to ensure that the liquidation price is below the stop-loss level to manage risk effectively.

Are there any recommended risk management strategies for beginners?

Beginners should consider setting stop-loss levels to limit potential losses, practicing proper position sizing based on risk tolerance, and sticking to a well-defined trading plan. Continuous learning and staying updated with market trends are also essential for managing risk effectively.

CRYPTO TIPS CRYPTO CASINO BONUSES (250+)